"Steve is equipped with Electronic Fool Injection" (itsalwayssteve)

"Steve is equipped with Electronic Fool Injection" (itsalwayssteve)

02/23/2014 at 15:43 • Filed to: None

0

0

15

15

"Steve is equipped with Electronic Fool Injection" (itsalwayssteve)

"Steve is equipped with Electronic Fool Injection" (itsalwayssteve)

02/23/2014 at 15:43 • Filed to: None |  0 0

|  15 15 |

But political and economic theory post after the jump:

Have a beautiful machine for your trouble.

Why is it that reasonable, rational adults accept facts of science only after getting verified, repeatable evidence, but can accept an economic theory which has been thoroughly debunked as ineffective and counterproductive on a macroeconomic scale?

Both the

!!!error: Indecipherable SUB-paragraph formatting!!!

and

!!!error: Indecipherable SUB-paragraph formatting!!!

have been shown not to work for anyone but the most powerful. Both, left to people and their human nature, lead to an oligarchic feudalism wherein the masses become oppressed and the middle class is eliminated. This is simply a fact of human nature — power and wealth are addictive.

The only nations that have escaped the current global recession are the ones which have embraced

!!!error: Indecipherable SUB-paragraph formatting!!!

- a blended economy where entrepreneurs are encouraged, but there are consequences for excessive greed, exploitation of resources, and environmental crimes.

All workers have their rights specifically legislated, there's a high minimum wage, and required paid time off. There's also a strong social safety net to catch the people for whom capitalism failed. All these countries also have a national health system and national universities that cost very little for citizens to attend.

Without the looming spectre of huge educational debt, there's significantly more freedom for students to become entrepreneurs and leaders of society. It also allows for anyone with the initiative to get the education to take it without the stresses that come from decades of debt.

These economies thrive because they are led by people who understand that a strong safety net doesn't encourage dependency or quash initiative. The freedoms don't lead to the rise of robber barons because there are consequences to exploitation. Regulations actually lead to product innovation because engineers and developers are challenged to work within them.

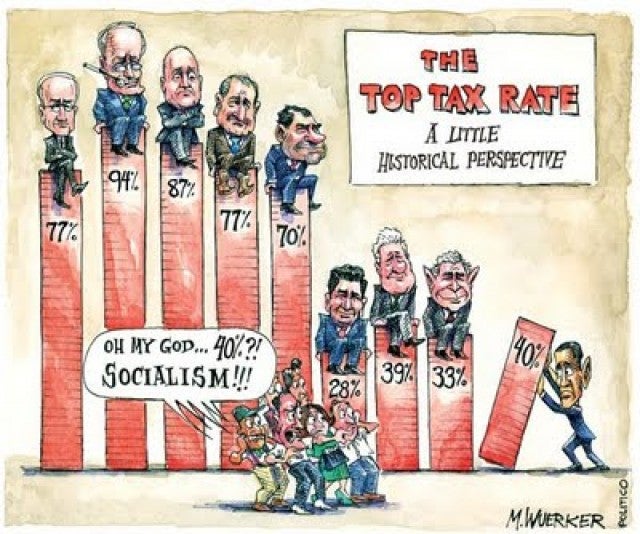

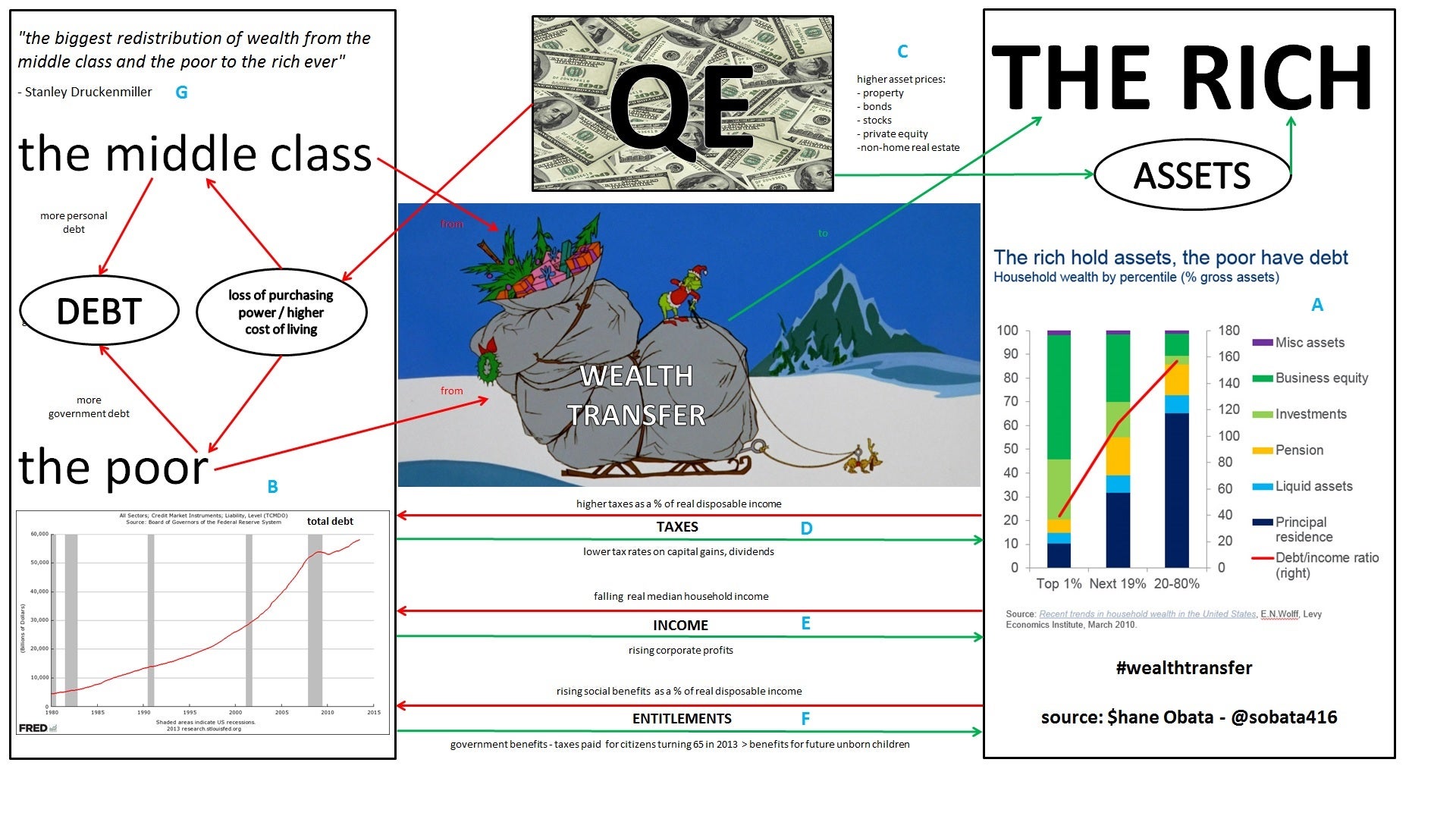

Progressive taxation means that companies will spend revenue in order to avoid excessive taxes on it. This leads to greater investment in research and development. All this leads to products are better for consumers, and the consumers have jobs that allow them to afford these new and improved products.

So, when I see a, "Taxed Enough Already," sticker, or a Che Guevara t shirt, I see the person displaying it as willfully ignorant of economic reality.

JACU - I've got bonifides.

> Steve is equipped with Electronic Fool Injection

JACU - I've got bonifides.

> Steve is equipped with Electronic Fool Injection

02/23/2014 at 15:56 |

|

Understanding and acceptance is simply different from implementation, especially if a significant portion of the voting population, through years of conditioning, have a sense of entitlement. In a democracy, self-determination can extend all the way to unintentional self-destruction.

Skif6996

> Steve is equipped with Electronic Fool Injection

Skif6996

> Steve is equipped with Electronic Fool Injection

02/23/2014 at 16:06 |

|

Dude, people are dumb.

Seriously, most people don't care enough to put any real thought or effort into politics or economics.

Chuck 2(O=[][]=O)2

> Steve is equipped with Electronic Fool Injection

Chuck 2(O=[][]=O)2

> Steve is equipped with Electronic Fool Injection

02/23/2014 at 16:10 |

|

First off, very well written. As an econ major myself I am almost offended when anyone thinks their interest are best suited by the government. After data, recognition, legislative, implementation, and effectiveness lag, the government is at least two years behind figuring out their own economic policies. Why the hell would you think your money is better suited in their hands. They are clueless and don't know what we demand.

The education point is a fantastic and strong one. In the next 5-20 years we will see productivity, and innovation of some sort, stunted because we are holding the youth back with debt. Another problem is that everyone is convinced they need to go to college. That is not true. Some people would be much better off going for a trade. Germany has done a great job instilling such values.

Entrepreneurship needs to be supported. We are selling out as a country to big business. Ideas don't come from the bug guys, it comes from people believing in their own ideas. It's fine if 90% fail in the first year, that what the economy is supposed to do. Supply with no demand is a bad business practice. But, at the very least we could encourage it. How did this country get started in the first place?

The safety net only works so well. In a country like America, I believe most would still rely on the state to support them. In this country people are quite frankly lazy and couldn't give a shit about the greater good. There isn't much foresight because people (here) seem to only live in the now. Why would I try at life when I have a check coming in twice a month.

Other than that, I complete agree.

JR1

> Steve is equipped with Electronic Fool Injection

JR1

> Steve is equipped with Electronic Fool Injection

02/23/2014 at 16:23 |

|

I am not an economist, but a history/poli sci major. And I can't help but wonder, why the current government wishes to take the wealthy so much. I read you article and it makes since kinda I am a little confused, but wasn't Reganomics equally as beneficial for the middle and poor class? With tax breaks on manufactures so the savings could be trickled down to the working class?

JasonStern911

> JR1

JasonStern911

> JR1

02/23/2014 at 16:40 |

|

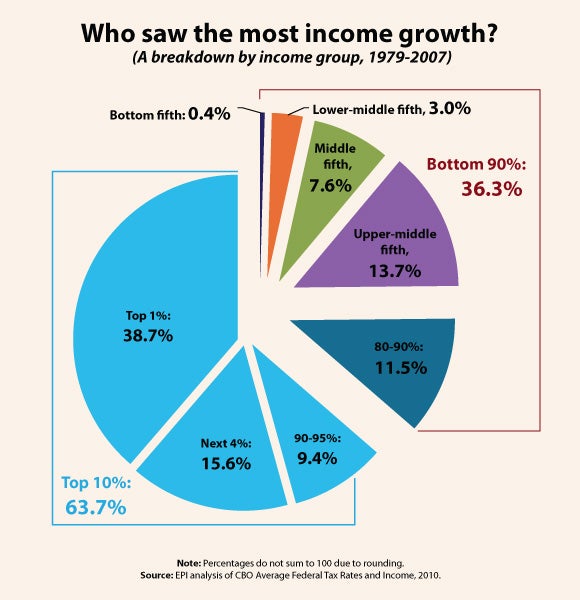

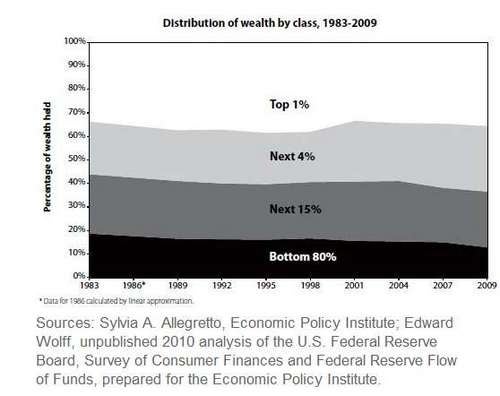

I'm not sure if you are you trolling... the rich are taxed well below their historical average and have for decades. the result has been a shrinking middle class and a consolidation of wealth by a very, very small minority.

JR1

> JasonStern911

JR1

> JasonStern911

02/23/2014 at 16:46 |

|

Nope not trolling apparently I'm just an uneducated idiot. The rich are taxed less, but is manufacturing taxed less?

samssun

> JasonStern911

samssun

> JasonStern911

02/23/2014 at 16:47 |

|

Federal tax rate is 40%, before State, SS/FICA, cap gains, property, sales, etc. So top earners pay over 50% in states like CA and NY. That's not just billionaires, that's anyone with a business that makes enough revenue to employ a handful of people.

Top 5% pay half of taxes, and the next 45% pay the rest...seems like "fair share" just means "more than now", or everything...

BoxerFanatic, troublesome iconoclast.

> Steve is equipped with Electronic Fool Injection

BoxerFanatic, troublesome iconoclast.

> Steve is equipped with Electronic Fool Injection

02/23/2014 at 16:52 |

|

People are inherently flawed, sinners, and susceptible to corruption.

Communism and socialism disregard this entirely, for the sake of the powerful exploiting everyone else for political and resulting economic control.

complete hands-off capitalism, which hasn't been tried in over 100 years, BTW... can devolve into fraud, abuse, and crony-corruption.

Power corrupts, and absolute power corrupts absolutely.

Your mentioned "Rhine" theory tries to have it both ways... enough free market to hope that the businessmen aren't corrupt, and enough government controls that hope that the government isn't corrupt.

But they both are, and always have been to some degree or another. All of humanity is corrupt and sinful to various extent from the smallest degree of people who make relatively innocent mistakes, to people who are truly evil.

Which is why limited government is a necessity for freedom, but what limited government there is should have the authority to prosecute fraud, racketeering and corruption, which ARE SEPARATE factors, and are not necessary ingredients to a functioning economy, but rather bi-products of un-ethical behavior.

Ethically functioning economics aside from those already illegal activities, should be protected from impediment, including over-regulation and over-taxation for the sake of government power and brokering control, often reffered to as the Government picking economic winners and losers, a common theme inherent in wealth redistribution, and the false-flag of "social justice".

The illegal activities should be strongly prosecuted by a government STRICTLY limited by due process and rules of evidence and burden of proof, by an ethically functioning government held to account by it's citizenry as a matter of the political process.

Excessive taxation and regulation STRANGLES ethical business, it doesn't prohibit or even dis-incentivize corruption, it FOSTERS it. A failing, oppressed market creates alternatives, corruption, and a black market to unethically obtain the success that is decreasingly possible in the over-regulated and over taxed, value-starved legitimate marketplace.

The concept of new rules and new ways for bureaucracy to validate it's existence through continued regulation for regulation's sake, and the taxation and monetary policy to support that bureaucracy FOSTERS unethical and crony-based economics to gain favor with the regulating bureaucracy.

Trickle-down doesn't work if the government taxes away the overhead.

Re-distribution of wealth doesn't work if the government runs out of other people's money.

Strictly limited government, with highly contained, specific, publicly accepted and authorized authorities for the prosecution of direct illegal activities, but not prohibition of any legal activities, is the way it works best. Not perfectly, but better than the other worse alternatives.

An assumption that anything is legal, until a truly representative, accountable, transparent government under strict constitutional limitation, legislates an activity as criminally illegal, is the way it is supposed to work for citizens. Citizens who then engage in private enterprise in their daily activity.

Assuming that everything is illegal until a government grants permission is oppression and subjugation of a population who languish under oppressive controls.

Politics and economics are inexorably linked, and cannot be separated any more than separating one side of a coin from the other.

samssun

> JR1

samssun

> JR1

02/23/2014 at 16:53 |

|

The rich pay 40% Federal, the State/SS/FICA, cap gains plus the extra 3.8% Obamacare kicker. Manufacturing pays the corporate rate of 35% (2nd highest in the world), plus any earnings returned as dividends get taxed again as cap gains. The article seems to think higher taxes will somehow help...I'm assuming he learned that from tax recipients.

Klaus Schmoll

> Steve is equipped with Electronic Fool Injection

Klaus Schmoll

> Steve is equipped with Electronic Fool Injection

02/23/2014 at 17:05 |

|

A very well written post! As a citizen of one of those countries that implemented these principles, I have to strongly agree. I am sometimes baffled by those who still think that a free market in it's purest sense is the only way to go. A free market without any borders or limitations will sort itself out, I agree with that. But it takes time. Time that is lost. People might have to suffer before change comes into effect. A few rules and regulations here and there might make for a much smoother ride.

I am always baffled by these "Obama=Communist" people. I'm not one to defend a guy who won the Nobel Peace Price for nothing, but I can understand where some of his ideas come from. We, on this side of the pond, are worried that the USA are headed to become a 2nd world country (infrastructure, child mortality rates, inferior education, millions of "working poor", etc.) I'm not sure I want to see this scenario unfold.

JasonStern911

> samssun

JasonStern911

> samssun

02/23/2014 at 18:16 |

|

I'm guessing you're a billionaire with nothing better to do than post on Oppo. Otherwise, you're ignorantly supporting a system in which wealth distribution is set up to ultimately leave the lower class completely dependent on government support.

Hell, even Warren Buffet admits he pays a lower tax rate than his secretary and you're advocating that he pays too much...?

JasonStern911

> JR1

JasonStern911

> JR1

02/23/2014 at 18:18 |

|

No idea, but I can assure you that unless tariffs are also significantly raised (which the government will not do as that has a tendency to piss foreign nations off), a lot of low wage manufacturing jobs are going overseas should Obama's proposed near 40% raise in minimum wage pass.

samssun

> JasonStern911

samssun

> JasonStern911

02/23/2014 at 19:55 |

|

Why don't we lower his secretary's taxes? She's paying 40% Fed alone, and he's comparing the taxes on his $1 token salary and cap gains (when he sells assets he was taxed on decades ago). Of course "champagne socialists" don't care about sky-high income taxes because they already have theirs..."progressive" taxes cripple those trying to BECOME rich (or upper middle class, etc).

When I hear his comparison, I take the limited government view that maybe we should stop looting his secretary's check, not an excuse to confiscate more from those already highly taxed. Politicians love to talk about "billionaires", but they're robbing anyone with any measure of success (Tom Cruise, the doctor down the street, and anyone with a small business all pay 40% Fed before they get hit with state taxes and the rest).

JasonStern911

> samssun

JasonStern911

> samssun

02/23/2014 at 21:51 |

|

Why don't we lower his secretary's taxes?

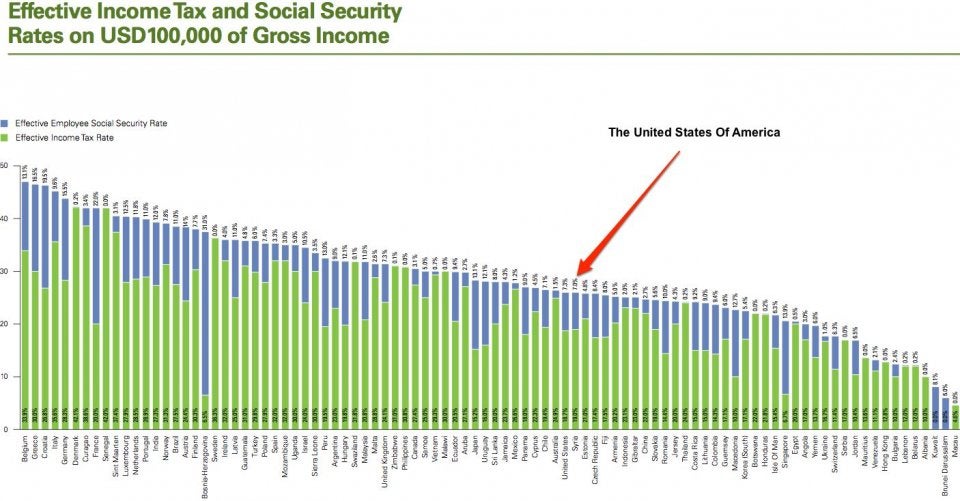

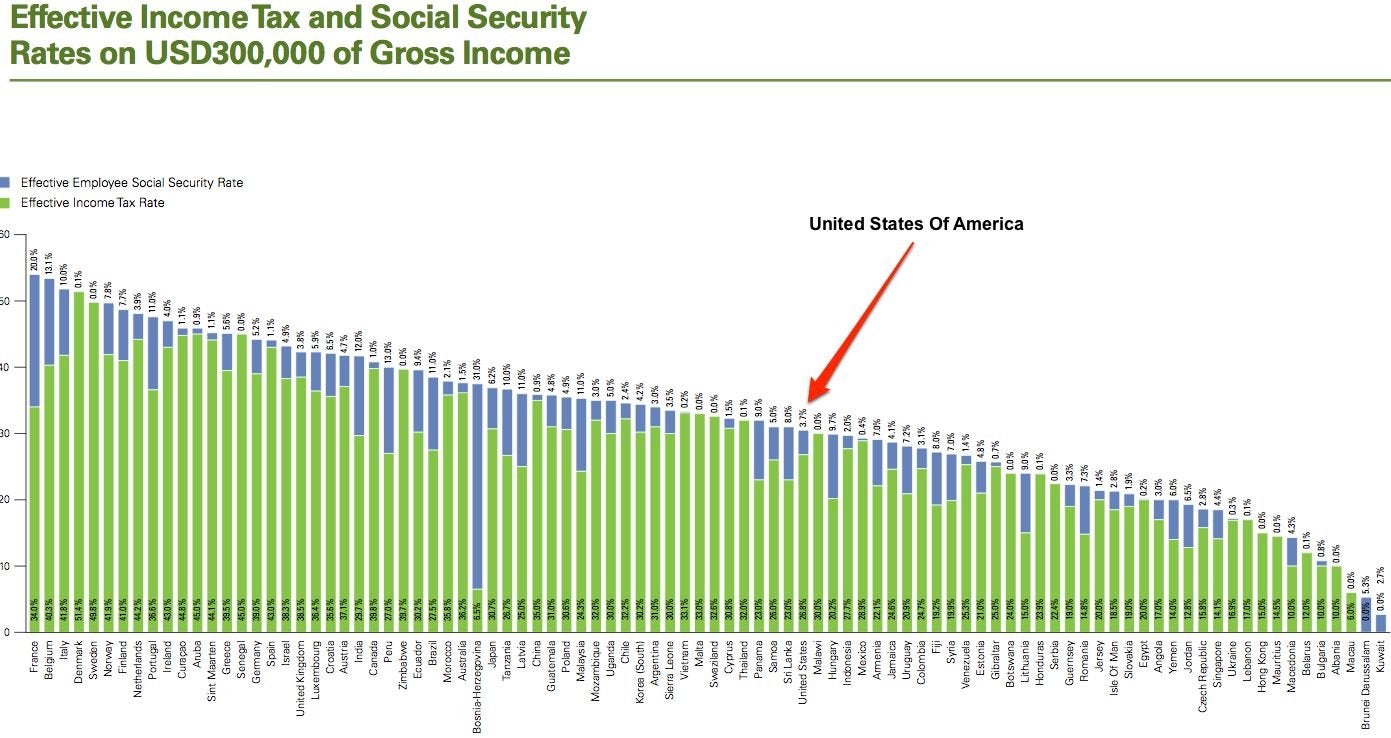

Because our government has a big enough spending problem as it is without reducing its income. In case you are unaware, America has been printing money at a unsustainable rate since late 2008. And if you honestly think that America's taxes are too damn high, realize that there are over 50 other countries with higher tax rates - not just for the middle class, but America's poor, persecuted multi-billionaires as well.

"progressive" taxes cripple those trying to BECOME rich (or upper middle class, etc).

Ignoring the fact that the truly rich also try to cripple those trying to become rich, progressive tax rates more easily allow the lower class to become middle class, reducing the need for America's recent socialist spending sprees.

The Fed is printing $85 billion a month and yet inflation is only 1.6%. The only way that is possible is if the banks (and the few with their hands in the bank's pockets) are just sitting on that fiat wealth.

But it's a moot point anyway. Even if the rich was taxed higher, the money wouldn't go towards infrastructure, research, affordable secondary education, and other such investments in our country, our people, and its future. Obama would just try to push some other socialist program like never expiring unemployment through.

they're robbing anyone with any measure of success (Tom Cruise, the doctor down the street, and anyone with a small business all pay 40% Fed before they get hit with state taxes and the rest).

Are they? The purpose of government is to enable the people of a nation to live in safety and happiness, and our government provides just that. And therein lies part of the problem. You sound ultra-conservative when it comes to taxation; however, you expect to be able to drive your car to the store (Department of Transportation) to buy edible food (Food and Drug Administration) without being injured/killed/mugged (various law enforcement agencies). Sure enough, that costs money. So while you may feel that taxes are the government robbing you, I can assure you that their version of robbing is much nicer than literally being robbed.

samssun

> JasonStern911

samssun

> JasonStern911

02/23/2014 at 23:44 |

|

"progressive tax rates more easily allow the lower class to become middle class"

How does government taking 1/3 of a middle class paycheck and 1/2 an upper class check help the lower class? It doesn't, it just funds more spending programs which cement the lower class into dependency.

The other countries you mention are just further along the game than we are: promise everyone you only want the rich to pay for everything, then when you run out of money keep redefining "rich" until it includes everyone still working for a living. Those countries went after the billionaires, millionaires, 250k-aires, 100k-aires, and now have 60k-aires paying the 35-50% rates, and it's still nowhere near enough...which leaves us with a more "progressive" system (the top paying everything) for now, but it continues to ratchet down.